Calendar of Events

Upcoming events and things to do in Asheville, NC. Below is a list of events for festivals, concerts, art exhibitions, group meetups and more.

Interested in adding an event to our calendar? Please click the green “Post Your Event” button below.

Come and join us for our Grand Opening of Over the Selvage. Those wearing costumes will receive 10% off their entire purchase. Party is Friday and Saturday, 10-6pm. Come to enter in for a door prize. Goodie bags will be given (while supplies last).

Normal hours are Wednesday-Saturday, 10 am -6pm.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

Chimney Rock honors veterans, reservists, retired and active military personnel with a free visit to Chimney Rock State Park from November 7-11, 2022. Must present military ID or proof of service.

.jpg)

To show support for Veterans and shine a light on the support services that Buncombe County has to offer, Buncombe County will be shining the green light for Veterans November 7-13 in three locations in downtown Asheville:

- Buncombe County Courthouse

- Health and Human Services Tower- Home to Buncombe County Veterans Services

- Buncombe County Family Justice Center

Spearheaded by the National Association of Counties (NACo), Operation Green Light aims to let those who served know they are seen, appreciated, and supported. Residents are encouraged to participate in this community-wide initiative by shining a green light for Veterans at your home or place of business. Together, we can show support and encourage the Veterans in our lives and communities to seek the resources they need to thrive here at home.

The contributions and sacrifices of the people who served in the Armed Forces have been vital in maintaining the freedoms and way of life enjoyed by all Americans. Upon returning to civilian life, many Veterans report experiencing high levels of stress due to financial hardship, mental health struggles, physical ailments, and lack of connection and community support.

Buncombe County stands in solidarity with Veterans and is home to a host of essential resources that can provide opportunities for health, safety, stability, and connection for those returning from service. Grounded in a commitment to support our Veterans, Heath Smith, Director of Buncombe County Veterans Services, accepted a proclamation from the Buncombe County Commissioners, designating Buncombe County as a Green Light for Veterans County. “Becoming a Green Light for Veterans County is an essential step in uniting our community in the effort to support local Veterans with the comprehensive resources and services they are entitled to.”

Veterans Services and Resources

BUNCOMBE COUNTY VETERANS SERVICES (BCVS)

6th Floor

40 Coxe Avenue in Downtown Asheville

Monday – Friday 8 AM – 5 PM

(828) 250-5726

BCVS offers essential benefits assistance to Veterans and their families. Services include:

- Health Care

- Home Loans

- Life Insurance

- Education & Training

- Vocational Rehabilitation & Training

- Burial Benefits

- Dependent & Survivor Benefits

- Disability Benefits

Charles George VA Medical Center

1110 Tunnel Road in Asheville

Open 24/7 for your convenience

Main phone: 828-298-7911

Mental health care: 828-298-7911 x2519

The Charles George VA Medical Center offers comprehensive medical care to Veterans and their families, including mental health care services, urgent care visits, and clinical care scheduling. Visit their website for a comprehensive list of medical services and support services offered at the Charles George VA Medical Center.

Veterans Treatment Court

60 Court Plaza- 9th Floor

Buncombe County Courthouse

(703) 389-9918

Veterans Treatment Court is an alternative to the conventional criminal justice system in which Veterans who are struggling to acclimate back into civilian life and find themselves charged with an offense are met with the support, structure, and resources they need to settle into life after service.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

Chimney Rock honors veterans, reservists, retired and active military personnel with a free visit to Chimney Rock State Park from November 7-11, 2022. Must present military ID or proof of service.

.jpg)

To show support for Veterans and shine a light on the support services that Buncombe County has to offer, Buncombe County will be shining the green light for Veterans November 7-13 in three locations in downtown Asheville:

- Buncombe County Courthouse

- Health and Human Services Tower- Home to Buncombe County Veterans Services

- Buncombe County Family Justice Center

Spearheaded by the National Association of Counties (NACo), Operation Green Light aims to let those who served know they are seen, appreciated, and supported. Residents are encouraged to participate in this community-wide initiative by shining a green light for Veterans at your home or place of business. Together, we can show support and encourage the Veterans in our lives and communities to seek the resources they need to thrive here at home.

The contributions and sacrifices of the people who served in the Armed Forces have been vital in maintaining the freedoms and way of life enjoyed by all Americans. Upon returning to civilian life, many Veterans report experiencing high levels of stress due to financial hardship, mental health struggles, physical ailments, and lack of connection and community support.

Buncombe County stands in solidarity with Veterans and is home to a host of essential resources that can provide opportunities for health, safety, stability, and connection for those returning from service. Grounded in a commitment to support our Veterans, Heath Smith, Director of Buncombe County Veterans Services, accepted a proclamation from the Buncombe County Commissioners, designating Buncombe County as a Green Light for Veterans County. “Becoming a Green Light for Veterans County is an essential step in uniting our community in the effort to support local Veterans with the comprehensive resources and services they are entitled to.”

Veterans Services and Resources

BUNCOMBE COUNTY VETERANS SERVICES (BCVS)

6th Floor

40 Coxe Avenue in Downtown Asheville

Monday – Friday 8 AM – 5 PM

(828) 250-5726

BCVS offers essential benefits assistance to Veterans and their families. Services include:

- Health Care

- Home Loans

- Life Insurance

- Education & Training

- Vocational Rehabilitation & Training

- Burial Benefits

- Dependent & Survivor Benefits

- Disability Benefits

Charles George VA Medical Center

1110 Tunnel Road in Asheville

Open 24/7 for your convenience

Main phone: 828-298-7911

Mental health care: 828-298-7911 x2519

The Charles George VA Medical Center offers comprehensive medical care to Veterans and their families, including mental health care services, urgent care visits, and clinical care scheduling. Visit their website for a comprehensive list of medical services and support services offered at the Charles George VA Medical Center.

Veterans Treatment Court

60 Court Plaza- 9th Floor

Buncombe County Courthouse

(703) 389-9918

Veterans Treatment Court is an alternative to the conventional criminal justice system in which Veterans who are struggling to acclimate back into civilian life and find themselves charged with an offense are met with the support, structure, and resources they need to settle into life after service.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

Chimney Rock honors veterans, reservists, retired and active military personnel with a free visit to Chimney Rock State Park from November 7-11, 2022. Must present military ID or proof of service.

.jpg)

To show support for Veterans and shine a light on the support services that Buncombe County has to offer, Buncombe County will be shining the green light for Veterans November 7-13 in three locations in downtown Asheville:

- Buncombe County Courthouse

- Health and Human Services Tower- Home to Buncombe County Veterans Services

- Buncombe County Family Justice Center

Spearheaded by the National Association of Counties (NACo), Operation Green Light aims to let those who served know they are seen, appreciated, and supported. Residents are encouraged to participate in this community-wide initiative by shining a green light for Veterans at your home or place of business. Together, we can show support and encourage the Veterans in our lives and communities to seek the resources they need to thrive here at home.

The contributions and sacrifices of the people who served in the Armed Forces have been vital in maintaining the freedoms and way of life enjoyed by all Americans. Upon returning to civilian life, many Veterans report experiencing high levels of stress due to financial hardship, mental health struggles, physical ailments, and lack of connection and community support.

Buncombe County stands in solidarity with Veterans and is home to a host of essential resources that can provide opportunities for health, safety, stability, and connection for those returning from service. Grounded in a commitment to support our Veterans, Heath Smith, Director of Buncombe County Veterans Services, accepted a proclamation from the Buncombe County Commissioners, designating Buncombe County as a Green Light for Veterans County. “Becoming a Green Light for Veterans County is an essential step in uniting our community in the effort to support local Veterans with the comprehensive resources and services they are entitled to.”

Veterans Services and Resources

BUNCOMBE COUNTY VETERANS SERVICES (BCVS)

6th Floor

40 Coxe Avenue in Downtown Asheville

Monday – Friday 8 AM – 5 PM

(828) 250-5726

BCVS offers essential benefits assistance to Veterans and their families. Services include:

- Health Care

- Home Loans

- Life Insurance

- Education & Training

- Vocational Rehabilitation & Training

- Burial Benefits

- Dependent & Survivor Benefits

- Disability Benefits

Charles George VA Medical Center

1110 Tunnel Road in Asheville

Open 24/7 for your convenience

Main phone: 828-298-7911

Mental health care: 828-298-7911 x2519

The Charles George VA Medical Center offers comprehensive medical care to Veterans and their families, including mental health care services, urgent care visits, and clinical care scheduling. Visit their website for a comprehensive list of medical services and support services offered at the Charles George VA Medical Center.

Veterans Treatment Court

60 Court Plaza- 9th Floor

Buncombe County Courthouse

(703) 389-9918

Veterans Treatment Court is an alternative to the conventional criminal justice system in which Veterans who are struggling to acclimate back into civilian life and find themselves charged with an offense are met with the support, structure, and resources they need to settle into life after service.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

Chimney Rock honors veterans, reservists, retired and active military personnel with a free visit to Chimney Rock State Park from November 7-11, 2022. Must present military ID or proof of service.

.jpg)

To show support for Veterans and shine a light on the support services that Buncombe County has to offer, Buncombe County will be shining the green light for Veterans November 7-13 in three locations in downtown Asheville:

- Buncombe County Courthouse

- Health and Human Services Tower- Home to Buncombe County Veterans Services

- Buncombe County Family Justice Center

Spearheaded by the National Association of Counties (NACo), Operation Green Light aims to let those who served know they are seen, appreciated, and supported. Residents are encouraged to participate in this community-wide initiative by shining a green light for Veterans at your home or place of business. Together, we can show support and encourage the Veterans in our lives and communities to seek the resources they need to thrive here at home.

The contributions and sacrifices of the people who served in the Armed Forces have been vital in maintaining the freedoms and way of life enjoyed by all Americans. Upon returning to civilian life, many Veterans report experiencing high levels of stress due to financial hardship, mental health struggles, physical ailments, and lack of connection and community support.

Buncombe County stands in solidarity with Veterans and is home to a host of essential resources that can provide opportunities for health, safety, stability, and connection for those returning from service. Grounded in a commitment to support our Veterans, Heath Smith, Director of Buncombe County Veterans Services, accepted a proclamation from the Buncombe County Commissioners, designating Buncombe County as a Green Light for Veterans County. “Becoming a Green Light for Veterans County is an essential step in uniting our community in the effort to support local Veterans with the comprehensive resources and services they are entitled to.”

Veterans Services and Resources

BUNCOMBE COUNTY VETERANS SERVICES (BCVS)

6th Floor

40 Coxe Avenue in Downtown Asheville

Monday – Friday 8 AM – 5 PM

(828) 250-5726

BCVS offers essential benefits assistance to Veterans and their families. Services include:

- Health Care

- Home Loans

- Life Insurance

- Education & Training

- Vocational Rehabilitation & Training

- Burial Benefits

- Dependent & Survivor Benefits

- Disability Benefits

Charles George VA Medical Center

1110 Tunnel Road in Asheville

Open 24/7 for your convenience

Main phone: 828-298-7911

Mental health care: 828-298-7911 x2519

The Charles George VA Medical Center offers comprehensive medical care to Veterans and their families, including mental health care services, urgent care visits, and clinical care scheduling. Visit their website for a comprehensive list of medical services and support services offered at the Charles George VA Medical Center.

Veterans Treatment Court

60 Court Plaza- 9th Floor

Buncombe County Courthouse

(703) 389-9918

Veterans Treatment Court is an alternative to the conventional criminal justice system in which Veterans who are struggling to acclimate back into civilian life and find themselves charged with an offense are met with the support, structure, and resources they need to settle into life after service.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

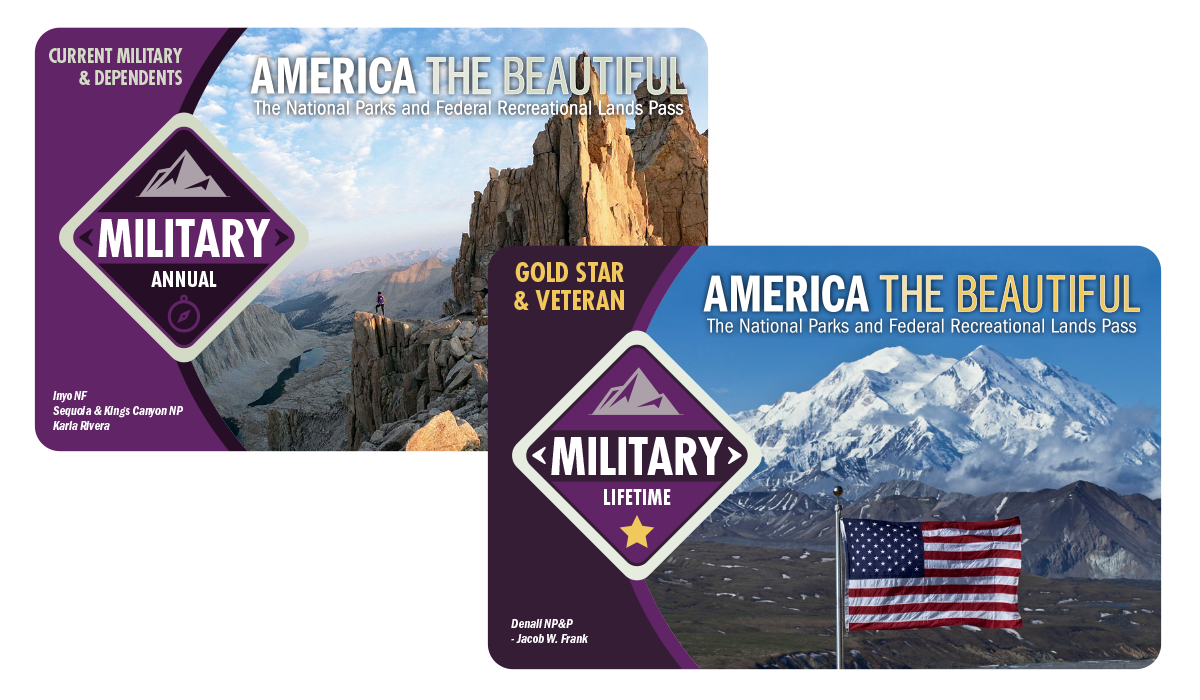

Many national parks have direct connections to the American military—there are dozens of battlefields, military parks, and historic sites that commemorate and honor the service of American veterans. In addition, every national park is part of our collective identity that defines who we are and where we came from as a nation. They are tactile reminders of the values, the ideals, and the freedoms that our veterans protect.

The majestic landscapes, natural wonders, and patriotic icons that we cherish as a society have also inspired military members through the years. The Grand Canyon, Mount Rushmore, the USS Arizona Memorial, and the Statue of Liberty are just a few of the national parks that have served as reminders of home to those stationed abroad. On Veterans Day, or any day, honor those who have served and sacrificed for our country with a visit to a national park.

The National Park Service invites all visitors to remember our veterans by visiting any National Park Service site for free on Veterans Day (November 11). Find tips to recreate responsibly while you visit!

This Veterans Day will be the first since Congress passed legislation granting free lifetime park passes to eligible veterans and Gold Star families, which can be obtained here. There are meaningful experiences waiting for veterans and all Americans in our parks this month and beyond!

Chimney Rock honors veterans, reservists, retired and active military personnel with a free visit to Chimney Rock State Park from November 7-11, 2022. Must present military ID or proof of service.

The Hendersonville Swing Band, under the direction of trombonist Jerry Zink, plays music of the Big Band era of the ‘30s, ‘40s and ‘50s. The band is primarily made up of musicians from Henderson, Transylvania, Haywood and Buncombe counties. Nearly all the members of the band are retirees. This is the first time the band has played a concert for Veterans Day.

Showtime is at 7:30 pm. Running time is approximately 2 hours with one 15 minute intermission. Hendersonville Theater has made masks optional for patrons, and no proof of vaccination is required to attend a performance.

.jpg)

To show support for Veterans and shine a light on the support services that Buncombe County has to offer, Buncombe County will be shining the green light for Veterans November 7-13 in three locations in downtown Asheville:

- Buncombe County Courthouse

- Health and Human Services Tower- Home to Buncombe County Veterans Services

- Buncombe County Family Justice Center

Spearheaded by the National Association of Counties (NACo), Operation Green Light aims to let those who served know they are seen, appreciated, and supported. Residents are encouraged to participate in this community-wide initiative by shining a green light for Veterans at your home or place of business. Together, we can show support and encourage the Veterans in our lives and communities to seek the resources they need to thrive here at home.

The contributions and sacrifices of the people who served in the Armed Forces have been vital in maintaining the freedoms and way of life enjoyed by all Americans. Upon returning to civilian life, many Veterans report experiencing high levels of stress due to financial hardship, mental health struggles, physical ailments, and lack of connection and community support.

Buncombe County stands in solidarity with Veterans and is home to a host of essential resources that can provide opportunities for health, safety, stability, and connection for those returning from service. Grounded in a commitment to support our Veterans, Heath Smith, Director of Buncombe County Veterans Services, accepted a proclamation from the Buncombe County Commissioners, designating Buncombe County as a Green Light for Veterans County. “Becoming a Green Light for Veterans County is an essential step in uniting our community in the effort to support local Veterans with the comprehensive resources and services they are entitled to.”

Veterans Services and Resources

BUNCOMBE COUNTY VETERANS SERVICES (BCVS)

6th Floor

40 Coxe Avenue in Downtown Asheville

Monday – Friday 8 AM – 5 PM

(828) 250-5726

BCVS offers essential benefits assistance to Veterans and their families. Services include:

- Health Care

- Home Loans

- Life Insurance

- Education & Training

- Vocational Rehabilitation & Training

- Burial Benefits

- Dependent & Survivor Benefits

- Disability Benefits

Charles George VA Medical Center

1110 Tunnel Road in Asheville

Open 24/7 for your convenience

Main phone: 828-298-7911

Mental health care: 828-298-7911 x2519

The Charles George VA Medical Center offers comprehensive medical care to Veterans and their families, including mental health care services, urgent care visits, and clinical care scheduling. Visit their website for a comprehensive list of medical services and support services offered at the Charles George VA Medical Center.

Veterans Treatment Court

60 Court Plaza- 9th Floor

Buncombe County Courthouse

(703) 389-9918

Veterans Treatment Court is an alternative to the conventional criminal justice system in which Veterans who are struggling to acclimate back into civilian life and find themselves charged with an offense are met with the support, structure, and resources they need to settle into life after service.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.

.jpg)

To show support for Veterans and shine a light on the support services that Buncombe County has to offer, Buncombe County will be shining the green light for Veterans November 7-13 in three locations in downtown Asheville:

- Buncombe County Courthouse

- Health and Human Services Tower- Home to Buncombe County Veterans Services

- Buncombe County Family Justice Center

Spearheaded by the National Association of Counties (NACo), Operation Green Light aims to let those who served know they are seen, appreciated, and supported. Residents are encouraged to participate in this community-wide initiative by shining a green light for Veterans at your home or place of business. Together, we can show support and encourage the Veterans in our lives and communities to seek the resources they need to thrive here at home.

The contributions and sacrifices of the people who served in the Armed Forces have been vital in maintaining the freedoms and way of life enjoyed by all Americans. Upon returning to civilian life, many Veterans report experiencing high levels of stress due to financial hardship, mental health struggles, physical ailments, and lack of connection and community support.

Buncombe County stands in solidarity with Veterans and is home to a host of essential resources that can provide opportunities for health, safety, stability, and connection for those returning from service. Grounded in a commitment to support our Veterans, Heath Smith, Director of Buncombe County Veterans Services, accepted a proclamation from the Buncombe County Commissioners, designating Buncombe County as a Green Light for Veterans County. “Becoming a Green Light for Veterans County is an essential step in uniting our community in the effort to support local Veterans with the comprehensive resources and services they are entitled to.”

Veterans Services and Resources

BUNCOMBE COUNTY VETERANS SERVICES (BCVS)

6th Floor

40 Coxe Avenue in Downtown Asheville

Monday – Friday 8 AM – 5 PM

(828) 250-5726

BCVS offers essential benefits assistance to Veterans and their families. Services include:

- Health Care

- Home Loans

- Life Insurance

- Education & Training

- Vocational Rehabilitation & Training

- Burial Benefits

- Dependent & Survivor Benefits

- Disability Benefits

Charles George VA Medical Center

1110 Tunnel Road in Asheville

Open 24/7 for your convenience

Main phone: 828-298-7911

Mental health care: 828-298-7911 x2519

The Charles George VA Medical Center offers comprehensive medical care to Veterans and their families, including mental health care services, urgent care visits, and clinical care scheduling. Visit their website for a comprehensive list of medical services and support services offered at the Charles George VA Medical Center.

Veterans Treatment Court

60 Court Plaza- 9th Floor

Buncombe County Courthouse

(703) 389-9918

Veterans Treatment Court is an alternative to the conventional criminal justice system in which Veterans who are struggling to acclimate back into civilian life and find themselves charged with an offense are met with the support, structure, and resources they need to settle into life after service.

PROCEEDS

This raffle is a fundraising event, and all net proceeds benefit the Brevard Music Center (BMC). Brevard Music Center is a 501(c)(3) nonprofit organization. EIN# 56-0729350

DRAWING

The drawing will take place on Tuesday, November 15, 2022 at 3:00pm EDT. All mail, phone, and internet orders must be received by 11:59pm EDT on Monday, November 14, 2022.

TICKETS

The cost to purchase a single entry (“Ticket”) for the Raffle is $125 (U.S. Funds only) and is not tax deductible.

DETAILS

- By entering this raffle, entrants accept and agree to be bound by all the rules, limitations and restrictions set forth here and that their names and/or likenesses may be disclosed to and used by the news media and may otherwise be used by BMC for publicity purposes.

- The winner may choose a new 2022 Volvo, Subaru, or Hyundai prize vehicle from Hunter Automotive Group of Fletcher, NC with an MSRP up to $50,000.

- Vehicle choice will be subject to the current available inventory of the dealer. BMC reserves the right to substitute a Volvo, Subaru, or Hyundai model of equal value.

- The winner is responsible for all taxes, delivery costs, dealer fees, and any options he or she may choose above the vehicle’s manufacturer’s suggested retail price (MSRP) greater than $50,000.

- The gross winnings of the raffle will be reported to the federal and state tax authorities at the MSRP and the winner is responsible for income tax withholding prior to taking title to the prize.

- Individuals may purchase as many tickets as they wish; however, only 1,500 tickets will be sold.

- Participants must be 18 years old or older.

- BMC employees, faculty, and students 18 or older are eligible to participate.

- Winnings are not redeemable for cash.

- If a minimum of 600 tickets is not sold, all ticket holders will receive a full refund and the raffle will not occur.

- BMC does not make or provide any representation, guarantee or warranty, expressed or implied, in connection with the car and accepts no liability or responsibility regarding the construction or condition of the car.

WINNINGS

Once the winner has selected a prize vehicle, the Dealer will notify BMC of the award vehicle’s MSRP. BMC will calculate the required federal income taxes due. The raffle winner is responsible for remitting the funds to BMC for the federal income tax. Brevard Music Center is required by law to report the base MSRP of the vehicle the winner chooses as gaming income to federal and state authorities and to withhold and deposit federal income taxes equal to 25% of the MSRP less the wager (raffle ticket). The winner’s payment of the federal taxes to BMC will be deposited with the US Federal Treasury and the winner will receive credit for the taxes remitted. In order for the dealer to release the winner’s vehicle, the winner will need to provide the following to BMC:

- A completed form W-9.

- Payment to BMC of the appropriate amount of federal tax withholding in cash or certified check.

Once both of these are received, BMC will authorize the dealer to release the vehicle. The winner will receive a Form W-2G by January 31, 2023 to use in preparing their 2022 income tax return.